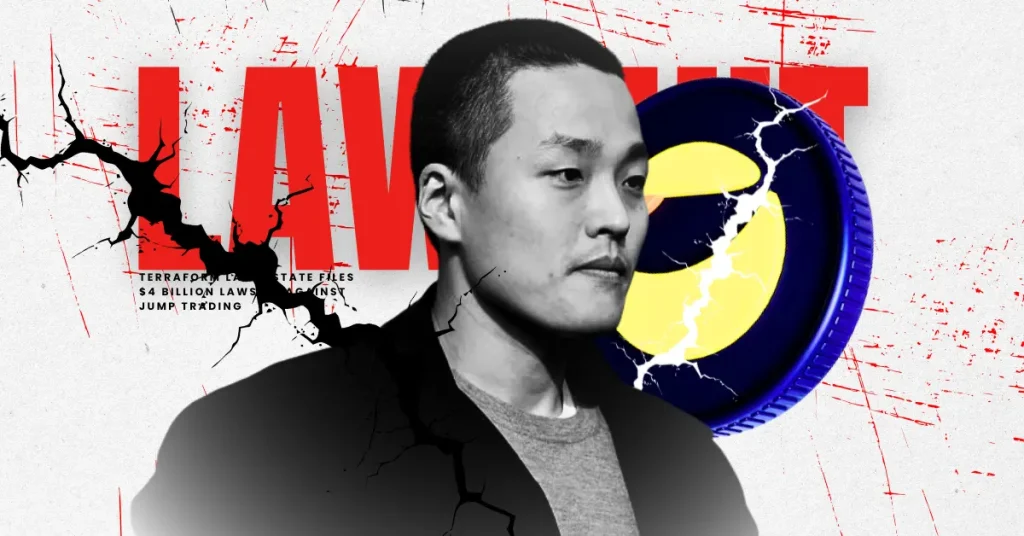

Terraform Labs Estate Files $4 Billion Lawsuit Against Jump Trading

The post Terraform Labs Estate Files $4 Billion Lawsuit Against Jump Trading appeared first on Coinpedia Fintech News

Terraform Labs’ bankruptcy estate has filed a $4 billion lawsuit against Jump Trading, accusing the high-frequency trading firm of secretly manipulating the Terra ecosystem and profiting from its collapse.

Meanwhile, responding to the claims, Jump Trading has rejected the allegations and said it will fight the case in court.

Terraform Labs Estate Accuses Jump Trading of Market Manipulation

According to a court filing in the U.S. District Court for the Northern District of Illinois, the administrator winding down Terraform Labs is seeking $4 billion in damages from Jump Trading.

The lawsuit names Jump Trading and its executives, William DiSomma and Kanav Kariya, accusing them of unfairly profiting and contributing to Terraform’s collapse in 2022.

During the crash, TerraUSD lost its dollar peg, triggering a chain reaction that wiped out nearly $40 billion and hurt the wider crypto market.

Terraform’s plan administrator, Todd Snyder, claims Jump benefited from secret deals that misled investors and distorted the market.

.article-inside-link {

margin-left: 0 !important;

border: 1px solid #0052CC4D;

border-left: 0;

border-right: 0;

padding: 10px 0;

text-align: left;

}

.entry ul.article-inside-link li {

font-size: 14px;

line-height: 21px;

font-weight: 600;

list-style-type: none;

margin-bottom: 0;

display: inline-block;

}

.entry ul.article-inside-link li:last-child {

display: none;

}

Secret Deals and Alleged False Narratives

Further, the lawsuit claims that Jump made secret deals linked to Terra’s stablecoin and LUNA as early as 2019. These deals allegedly allowed Jump to buy large amounts of LUNA at very low prices.

In one case, Jump is said to have bought LUNA for just $0.40, before prices later jumped above $110.

The filing also says Jump was later allowed to sell these tokens earlier than others by removing lock-up rules. This helped Jump make nearly $1 billion in profits, while many investors suffered heavy losses.

Because this support was not disclosed, investors believed the system was stable. When UST collapsed in May 2022, it wiped out about $40 billion in value and became one of crypto’s biggest crashes.

Jump Trading rejected the Claims

Jump Trading has rejected the claims, calling the lawsuit an attempt to shift blame away from Terraform’s failed design. The firm has said it plans to defend itself strongly in court.

Terraform Labs collapsed in 2022 when TerraUSD, an algorithmic stablecoin, lost its peg to the US dollar. Its sister token, LUNA, quickly crashed to near zero, wiping out roughly $40 billion in market value.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bankruptcy estates are required to identify and pursue claims that could recover funds for creditors. This lawsuit is part of that process, aiming to determine whether third-party actions materially contributed to losses and whether recoverable damages exist.

If the claims gain traction, trading firms may face greater scrutiny over private agreements, lock-up terms, and disclosure practices. This could lead to tighter compliance standards and more transparency around how liquidity support is structured.

Terraform creditors and former token holders could benefit if damages are awarded and distributed through the bankruptcy process. More broadly, the case may influence how courts assess responsibility in large-scale crypto failures involving multiple market participants.